Lexicon Financial Group Weekly Update — November 26, 2025

“I often tell my students not to be misled by the name ‘artificial intelligence’ - there is nothing artificial about it. AI is made by humans, intended to behave by humans, and, ultimately, to impact humans’ lives and human society.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

ISSUE 206

Looking Around

Global stock markets have been on the retreat recently due to growing concerns about sky-high stock valuations as well as anxiety about whether artificial intelligence (AI) will generate enough profits to justify the massive spending that is being poured (and continues to be poured) into supporting the development of AI technology.

In 2026, global spending on artificial intelligence is supposed to reach close to half a trillion dollars. Investment in AI is based on the promise that it may one day concoct miracle drugs, program anything, automate everything, etc. The billion-dollar question here is, “When this will happen?” And will AI initiatives ever generate enough profit to make up for this staggering amount of investment?

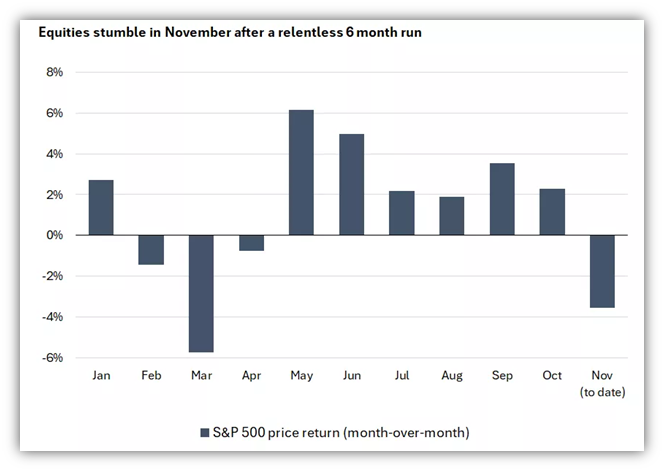

The S&P 500 Index is still on pace to potentially return more than 20 per cent for a third year running. The last time this happened was during the internet bubble in the late 1990s, which perhaps is fueling some fears that we are simply in a new bubble.

At the end of October, price-to-earnings (P/E) ratios on the S&P 500 Index were nearly 24 times, which is roughly 50 per cent above their long-term historical average. As a reminder, the P/E ratio of a company is fairly simple to calculate – the price of the shares divided by their earnings. It’s a reflection of how much the market of investors are willing to pay for those earnings. In theory, if earnings grow, the price must also grow to maintain the same ratio. So, using traditional measurements, the market is somewhat overvalued. It’s worth remembering, though, that at the peak of the dot-com bubble companies were trading with P/E ratios of over 70 – three times more heated than they are today.

The S&P 500 is dominated by mega-cap growth stocks as concentrated as it has been with the top 10 stocks accounting for 40 per cent of its return profile as of October this year. And most of those massive companies are growing. Growing companies tend to have higher P/E ratios, so the index as a whole starts to look more “growthy” than at other points in time when more stable, value-oriented companies like General Electric or IBM dominated. Despite this, we are seeing terms like “bubble” and “irrational exuberance” in the headlines and on social media. (1)

But what if AI is actually a bubble?

The amount of money and energy that’s being poured into AI is staggering. Global spending is projected to hit $375 billion this year. But AI has not yet made money on a scale that even remotely matches these mind-boggling investments. A significant amount of the U.S.’s economic growth (as measured by the stock markets) is currently fueled by AI. Actually, it is probably more accurate to say that it’s fueled by the promise of AI. According to a recent McKinsey report, 80 per cent of the companies they surveyed that were using AI discovered that the technology has yet to have a significant impact on their bottom line. The tools are great for creating funny videos, it seems, but real world application aren’t yet what they were promised to be.

Those of us who invested through the dot-com boom have every right to be cautious. But there is no doubt that the internet was an innovation that changed almost every aspect of global business. Sure, companies like Pets.com came and went, but the technology that built them in the first place remained. The dynamic of the dot-com crash wasn’t that the internet was a fad; it was that an enormous amount of investment came in, and all these companies were created, and the ecosystem wasn’t yet developed enough to support them. Perhaps some of today’s AI companies are just ahead of their time.

Underpinning all of this is the real investor fear of missing out (“FOMO”). Or “this time is different.” These are age-old behaviour traps common to financial theory. Every market cycle is unique; some will follow historical patterns and some won’t. And as we all know, history has a habit of repeating itself. (2)

Today, almost all investors are exposed to AI in some shape or form. It’s the backbone of the current market rallies. Investors have benefitted tremendously from the growth of these companies. We continue to provide meaningful exposure to this area but won’t hesitate to make adjustments if we feel things are getting too risky. We’re not anywhere close to excessive valuations of 2001. Not yet anyway.

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

An unusual trend in the economy is worrying the Fed

Europe’s economy is geared towards a disappearing world, says ECB’s Lagarde

Japan announces $135 billion stimulus, NHK reports, in bid to support economy and consumers

Vanke (Chinese property firm) seeks yuan bond extension for first time

Looking Back

Last week, global markets experienced another bout of volatility, as stocks finished lower, continuing the worst run for the markets since the tariff-driven sell-offs in April this year.

Although the S&P/TSX composite index (TSX) clawed back much of its weekly decline last Friday due to rising financial and technology stocks, it ended down 0.5 per cent for the week. Energy was the only one of 10 major sectors of the TSX to end lower, as oil prices settled lower. (3)

In the United States (U.S.), some good news during last week from both corporate earnings reports and government economic data could not stop major stock markets finishing lower. This downward move appeared to be driven by concerns about lofty stock valuations and anxiety about whether AI will generate enough profits to justify the massive spending that companies have poured into supporting the developing technology.

The tech-heavy Nasdaq Composite had the largest losses, while the large cap S&P 500 Index finished about 4.4 per cent lower than the record high it achieved in late October. Just like in Canada, a rebound during a volatile day of trading last Friday helped ease the losses that the major markets had suffered earlier in the week but could not stave off the market’s move lower.

Source: Bloomberg, S&P 500 Price Index, Edward Jones

On the economic front, the U.S. Labor Department’s monthly employment report for September, which was delayed for six weeks by the government shutdown, was finally released last Thursday. It provided a mixed view of the U.S. economy as it showed that although 119,000 jobs were added for the month (significantly higher than expected, and much better than over the summer when hiring virtually stopped), the unemployment rate, which is computed in a separate survey, ticked up to 4.4 per cent in September – its highest level in four years, from the previous month’s 4.3 per cent. The Bureau of Labor Statistics also announced that the next employment report, covering November, will be released on December 16 and that the report for October has been canceled. This has raised hopes of another interest rate cut by the U.S. Federal Reserve (Fed). According to CME Group data based on the futures market, as of last Friday, there was a nearly 70 per cent chance that the Federal Reserve would cut rates at its next meeting, up from 44 per cent a week earlier.

Last week saw the pan-European STOXX Europe 600 Index fall 2.21 per cent, amid renewed worries about inflated artificial intelligence (AI) stock valuations. Declining expectations for a U.S. interest rate cut before year-end also weighed on sentiment. Other major European stock indexes also fell.

Much like elsewhere, Japan’s stock markets lost ground last week due to sharp declines in the shares of Japanese AI-related technology companies, fueled by ongoing concerns about overstretched valuations. As expected, Japan’s government approved an economic stimulus package worth around JPY 21.3 trillion (about USD 135 billion) under the new prime minister, Sanae Takaichi. The package, which comprises spending, tax breaks, and investment targeted at key segments of the economy such as shipbuilding and AI, is aimed at boosting economic growth in Japan and helping cushion households against the negative impacts of inflation. Gross domestic product (GDP) in Japan contracted by less than anticipated over the third quarter of 2025, shrinking 1.8 per cent on an annualized basis versus consensus estimates of a 2.4 per cent fall and compared with revised growth of 2.3 per cent in the second quarter. However, external demand was notably weak, with U.S. tariffs weighing on Japanese exports.

Mainland Chinese stock markets recorded a loss last week, which mirrored the fall of global stock markets. Similar to elsewhere, investor concerns about frothy valuations in AI-focused names dampened risk appetite.

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

Healthy bull or bloated bubble? A stock picker’s take, Tony DeSpirito, Global CIO, BlackRock Fundamental Equities, AdvisorAnalyst.com, November 24, 2025

What If AI Is a Bubble? Hanna Rosin, The Atlantic, November 13, 2025

TSX pares weekly decline as Fed rate cut bets rise, Fergal Smith, Reuters via MSN, November 21, 2025

Global markets weekly update - AI concerns weigh on market sentiment, T. Rowe Price, November 21, 2025

SUBSCRIBE

If you’d like to automatically receive the Weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

Are we in an AI bubble? Here’s what analysts and experts are saying

AI has an environmental problem. Here’s what the world can do about that.