Lexicon Financial Group Weekly Update — October 15, 2025

“Many economists and industry experts agree that the United States faces unfair competition and artificially low prices that have damaged the domestic steel industry. But they don’t agree that a tariff is the right approach for addressing the problem.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

ISSUE 200

Looking Around

It looks like our assessment of the impact of the Trump tariffs last week was timely. The tariff tit-for-tat had gasoline poured on it when President Trump announced that he would impose a 100 per cent tariff on all products from China, in response to China’s curbs last week on rare-earth minerals.

This tariff will take effect on November 1 and be imposed “over and above” other tariffs on Chinese exports, which are already 30 per cent and higher in some cases. And, it will be accompanied by the United States (U.S.) placing export controls on critical software. Trump has also signalled that his meeting in two weeks at an international economic conference in South Korea with President Xi of China may not happen.

Markets, predictably, reacted quickly. Almost all major markets saw sharp declines, but many recovered just as quickly.

Rare-earth minerals have been at the centre of tensions between the U.S. and China for some time. In April, the Chinese government clamped down on mineral exports destined for U.S. automakers and defense manufacturers. The Trump administration then tried to persuade China to back down by restricting exports of chip design software, airplane engines and other products. Ultimately, officials from both countries reached a fragile truce in spring, which resulted in Trump reducing his tariffs and Beijing approving more mineral exports.

But, last week, the Chinese government said it would require companies anywhere in the world to obtain licenses if they are exporting products containing even a minimal amount of Chinese-produced rare earths, including for chip manufacturing. Those exports would also be controlled if the minerals were produced using Chinese mining, processing or magnet-making technologies. Any company with any affiliation to foreign militaries would be denied these licenses.

These restrictions are similar to the global restrictions that the United States has put on semiconductors, which dictate that any company using American chip technology anywhere in the world must follow U.S. guidelines.

What’s interesting is that China mines 70 per cent of the world’s rare earths and performs the chemical processing for roughly 90 per cent of the global supply of the minerals. So, the new restrictions have caused significant anxiety among U.S. companies. In fact, without much competition for rare earth minerals, China pretty much has the market cornered and can make up the global rules until new competitors emerge.

These new limits could scramble the supply chains of some of the world’s biggest companies, including Nvidia and Apple. Given the dominance of the technology sector in U.S. stock markets, it is not surprising that these markets were impacted.

If the retaliation and counter-retaliation continue, it could posibbly trigger a full- blown trade war that would increase the current economic impact. This spat has already had casualties: China’s retaliatory tariffs on U.S. soybean exports have had a crippling impact this year. (1)

Remember, tariffs generally fall into two categories:

1- Taxes imposed on imports arriving from certain countries, and

2- Duties that apply to specific products, often without regard to their origin.

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

Canada’s economy added 60,000 jobs in September, rebounding from two months of losses

Fed's Powell addresses economy pulled between risks to growth, jobs and prices

Germany's Economy Is Forecast to Outperform in 2026

IMF revises Japan's economic forecast higher, sees gradual BOJ rate hikes

Most recently, the U.S. has used a provision of federal law — Section 232 — meant to address trade issues that present national security threats, to impose duties on selected products: imported steel, aluminum, cars, car parts, heavy-duty trucks, lumber and wood products, including bathroom and kitchen cabinets and upholstered furniture.

These tariffs took effect on October 14, and in some cases, will rise again in the coming months. For countries like the United Kingdom and the European Union, agreements brokered with the U.S. would override the sector-specific duties. Currently, Bolivia, Ecuador, Iceland, Nigeria and many other nations have tariff rates of 15 per cent, while others, including Sri Lanka, Taiwan and Vietnam, face duties of 20 per cent. Some of the highest tariffs have been applied to imports from Brazil, which are subject to a tariff of 50 per cent. India saw initial tariffs of 25 per cent on its exports to the U.S. double on August 27, stemming from the country’s purchase of Russian oil.

Going forward, the main focus will be on the U.S.-China trade relationship, as the 30 per cent baseline U.S. tariff on most imports from China, agreed to earlier this year, will expire on November 10. The last time these two superpowers came to blows over export restrictions and tariffs, trade between them ground to a halt, which rattled financial markets and raised fears of price increases (aka inflation) for U.S. consumers. (2)

We are monitoring the global tariff impact, as it can potentially roil stock markets from New York to Shanghai and beyond. The Trump administration is gambling that its policies can reset the world trading order, raise new federal revenue and pressure private businesses to make more of their products domestically. As with everything else, only time will tell if this gamble pays off.

Looking Back

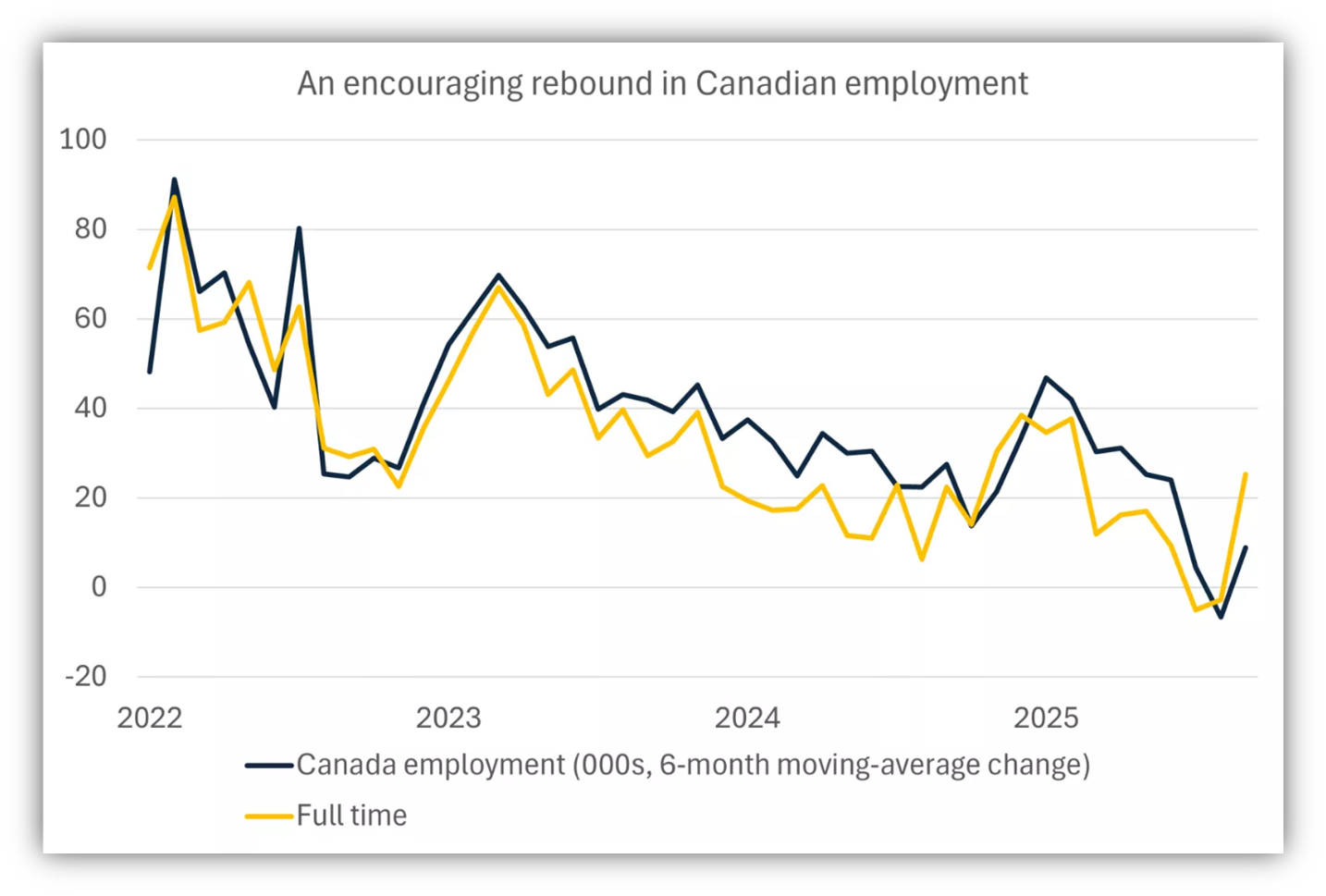

The S&P/TSX composite index (TSX) ended last week down two per cent, which snapped more than a few weeks of upward momentum. This is its biggest decline since April, as increased trade tensions between the United States and China provided a catalyst for profit-taking despite better-than-expected jobs domestic data – Canada's economy added 60,400 jobs in September, which far eclipsed forecasts of a 5,000 increase.

Source: Haver Analytics, Edward Jones

Just like elsewhere, trade policy uncertainty remains an important driver for the TSX. (3)

U.S. stock indexes declined last week due to fears of a re-escalation of global trade tensions and rising concerns around the impacts of a prolonged U.S. government shutdown. For most of last week, the Nasdaq Composite and S&P 500 Index were in positive territory, buoyed by ongoing enthusiasm for companies with artificial intelligence exposure that was supported by several new deal announcements ,such as a strategic partnership between Advanced Micro Devices and OpenAI Stock. Then, on Friday, after Trump posted on social media that he is considering “a massive increase of tariffs on Chinese products” in response to China’s proposed new export controls on rare earths, stock markets turned sharply lower. Underscoring the heightened level of geopolitical and economic uncertainty, the price of gold surpassed USD 4,000 per ounce for the first time ever. For now, investors appear to be looking ahead to the third-quarter earnings season. These earnings could have an outsized impact on markets and investor sentiment due to the U.S. government shutdown causing a lack of major economic data releases. Minutes from the Federal Reserve’s September meeting, released last week, signalled cautious support for more interest rate cuts before the end of this year, which could also have a significant impact.

U.S. Treasuries generated positive returns as yields decreased sharply in response to re-escalating U.S.-China trade tensions late in the week (bond prices and yields move in opposite directions). Government shutdown risks also appeared to contribute to safe-haven demand for Treasuries during last week.

STOXX Europe 600 Index ended 1.10 per cent lower last week, as investors took profits and political turmoil in France and international trade tensions weighed on investor sentiment. Other major European stock indexes also lost ground. Recent economic data for Germany showed signs of further weakness, as the impact of front-loading ahead of a U.S. tariff deadline in April wore off. Germany’s coalition government unveiled measures to cut budget costs and to promote the auto industry, including restrictions on welfare recipients and subsidies for purchasing German-made electric vehicles.

Japan’s stock markets rose sharply last week, as investors reacted positively to Sanae Takaichi winning the Liberal Democratic Party’s (LDP) presidential election, which set the stage for her to become Japan’s next prime minister. The electoral outcome was viewed as favourable for stocks, while the yen weakened on expectations of expansionary fiscal stimulus and continued loose monetary policy.

Stock markets in mainland China ended a holiday-shortened week on a mixed note. Preliminary data suggested that consumption during China’s so-called Golden Week lagged the activity during the five-day Labour Day holiday in May. The underwhelming consumption data comes as China is trying to rebalance the economy to favour domestic spending and services and pivot away from industry and exports. (4)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

In Retaliatory Move, Trump Threatens 100% Tariffs on Chinese Goods, Ana Swanson, The New York Times, October 10, 2025

Tracking Trump Tariffs on Countries and Products, Tony Romm, Lazaro Gamio, Agnes Chang and Jacqueline Gu, The New York Times, October 14, 2025

TSX posts biggest decline in six months as global trade tensions rise, Fergal Smith, Reuters, October 10, 2025

Global markets weekly update - U.S.-China trade tensions reignite, T. Rowe Price, October 10, 2025

SUBSCRIBE

If you’d like to automatically receive the Weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

China Played Its Strongest Card to Get Trump’s Attention. Will it Work?

What are rare earth minerals, and why are they central to Trump’s threats against China?

China Bought $12.6 Billion in U.S. Soybeans Last Year. Now, It’s $0

China is gambling that tanking stocks will force Trump to cave. His team says it's digging in