Lexicon Financial Group Weekly Update — October 1, 2025

“AI might be a powerful technology, but things won’t get better simply by adding AI.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

ISSUE 198

Looking Around

There is no doubting that artificial intelligence (AI) has been a significant driver of stock market growth for several years, particularly in the United States (U.S.). Leading artificial intelligence companies would largely be considered as technology companies, although other sectors and industries benefit from this trend. Someone has to generate all the power to run the computers, after all.

The technology sector has been a major contributor to the global economy over the last few years. It is now the dominant sector overall in the S&P 500. More recently, investment performance has been dominated by a group of firms referred to as "Magnificent 7". You know the names: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The technology sector and the Magnificent 7 have outperformed the broader market over the past 20 years. This trend is even more pronounced over the last decade, where the sector exceeded the broader market by 300 bps. (1)

In the past five years, tech ex-Mag 7 has also managed to outperform the broader market, demonstrating that substantial growth is not confined to the sector's largest players. As you can see from the chart below, the tech sector’s share of total U.S. market capitalization is the largest.

Source: Visual Capitalist

That said, AI has moved to centrestage across numerous sectors ranging from AI-generated art to chatbots in customer service, and it looks like every sector is seemingly poised for disruption. This has led to venture capital pouring into the AI sector, CEOs eager to declare their companies “AI-first” and investors looking to take advantage of the AI phenomenon.

If this sounds familiar, it should.

In 2017, blockchain promised to transform every industry. Companies added “blockchain” to their name and watched stock prices skyrocket, regardless of whether the technology was actually used, or how. U.S. soft drinks company Long Island Iced Tea Corporation became Long Blockchain Corporation and saw its stock rise 400 per cent overnight, despite having no blockchain product. Kodak launched a vague cryptocurrency called KodakCoin, sending its stock price soaring. These moves were less about innovation and more about speculation, chasing short-term gains driven by hype. Most blockchain projects never delivered real value even though companies rushed in, driven by fear of missing out and the promise of technological transformation. Everything from tracking pet food ingredients on blockchain to launching loyalty programs with crypto tokens was attempted but mid-2019, about 90 per cent of enterprise blockchain solutions failed. What’s more is that blockchain is not making the headlines as much these days.

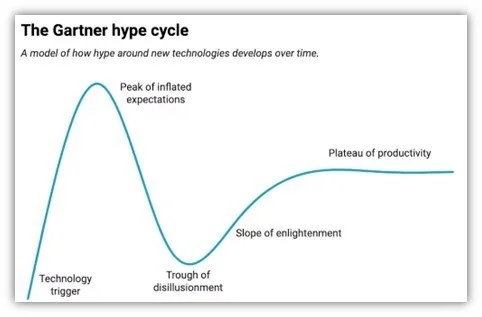

It looks like AI is following a similar path. According to the research firm Gartner, this is typical of what it calls the tech hype cycle, which shows how emerging technologies rise on a wave of inflated promises and expectations, crash into disillusionment and, eventually, find a more realistic and useful application.

Source: The Conversation

It is important to recognise the signs of this cycle becasuse it helps in distinguishing between genuine technological shifts and passing fads driven by speculative investment and good marketing. More importantly, it can mean the difference between making a good business decision and a very costly mistake. Meta, for example, invested more than US$40 billion into the metaverse idea while seemingly chasing their own tech hype, only to abandon it later.

Meta is not alone in this as, in 2023, digital media company BuzzFeed announced it would use AI to generate quizzes and content, and saw its stock jump more than 100 per cent. Financial services company Klarna replaced 700 workers with an AI chatbot, claiming it could handle millions of customer queries. However, BuzzFeed’s AI content push failed to save its struggling business and its news division later shut down. Klarna saw a decline in customer satisfaction and was forced to walk back its strategy and rehire humans for customer support this year.

AI is a legitimate technological innovation with real, transformative potential. Like past technological innovations, it just needs time to find the right application. It looks like the current AI hype cycle appears to be tapering off, and the consequences of rushed or poorly thought-out implementations will likely become more visible in the coming years. This doesn’t signal the end of generative AI’s relevance but rather marks the beginning of a more grounded phase where the technology can find the most suitable applications. (2)

Our clients have been exposed to technology through investments in several different exchanged-traded funds and get diversification. We continue to hold significant client assets in the largest U.S. companies, which these days includes the Magnificent 7.

We still believe the technology sector will be a driving force in the global economy for years to come. Some of that will be powered by AI, and some of that will be powered by things that have yet to be invented. Great companies will grow and emerge. Just as they’ve always done.

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

Canada’s economy could rebound in 2026 — but there’s a catch: report

Will a government shutdown hurt the US economy?

China’s Economy Trolling Trump Better Than A Mean Tweet

Europe’s top central banker says economy resilient despite Trump tariffs

Japan’s Tankan survey shows economic resilience amid trade tensions

Looking Back

Although the S&P/TSX composite index (TSX) edged higher last Friday as commodity prices rose and economic data pointed to Canada's economy avoiding a recession, it still lost its weekly winning streak. For the week, the TSX was down 0.02 per cent. (3)

Major U.S. stock indexes finished lower last week. This decline was driven in part by some hawkish commentary from Federal Reserve (Fed) officials that seemed to dampen investor optimism around the pace of further interest rate cuts. According to the Bureau of Economic Analysis’ (BEA) closely-watched core personal consumption expenditures (PCE) price index (which excludes food and energy costs and is the Fed’s preferred measure of inflation), inflation in the U.S. was little changed in August. The index showed a 0.2 per cent rise in prices from the July index, which was in line with estimates. On a year-over-year basis, the index rose 2.9 per cent, which is also in line with July. Personal spending and income both rose a tick higher than expectations at 0.6 per cent and 0.4 per cent, respectively. The BEA also released its third estimate of U.S. gross domestic product (GDP) growth for the second quarter, which indicated that the U.S. economy expanded at an annual rate of 3.8 per cent, with higher consumer spending being the primary driver of the expansion.

U.S. Treasuries generated negative returns, with short- and intermediate-term yields increasing and long-term yields ending little changed. Remember that bond prices and yields move in opposite directions. Rate cut expectations declined amid the week’s generally stronger-than-expected economic data and hawkish Fed commentary, which appeared to drive the yield changes.

The pan-European STOXX Europe 600 Index ended little changed, as investors assessed interest rate policies and renewed trade jitters weighed on sentiment. Other major stock indexes were firmer. The eurozone economy maintained a modest pace of growth in the third quarter, according to purchasing managers’ surveys. Services activity grew at the fastest pace this year, which drove the overall increase, while manufacturing output expanded at a slower pace. Companies, however, remained optimistic that output will grow over the coming year, but weaker confidence in manufacturing caused overall business confidence to dip to a four-month low.

Japan’s stock markets rose over the week, as expectations of a near-term interest rate hike by the Bank of Japan (BoJ) were tempered by a lower-than-expected Tokyo area consumer inflation print. The Tokyo area consumer price index (a leading indicator of nationwide trends) rose 2.5 per cent year on year in September, holding steady from the prior month and short of economists’ estimates of a 2.8 per cent gain. Political uncertainty also weighed on the yen due to the range of possible outcomes in the Liberal Democratic Party’s (LDP) presidential election.

Mainland Chinese stock markets recorded a gain last week. No major economic indicators or corporate earnings were released during the week, which gave investors little news to act on. A high level of domestic liquidity continues to fuel strong gains in China’s stock markets since April, as cash-rich households seek higher returns amid low interest rates and a lack of better investing options.

Recent breakthroughs in homegrown artificial intelligence startups and Beijing’s “anti-involution” campaign to curb excessive price competition in several industries have also boosted investor risk appetite, despite recent data pointing to a growth slowdown and persistent deflation. (4)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

Breaking down the stunning tech outperformance in last 20 years, Navamya Acharya, Investing.com, September 9, 2024

The AI hype is just like the blockchain frenzy – here’s what happens when the hype dies, Gediminas Lipnickas, The Conversation, June 10, 2025

TSX ends higher but not by enough to extend weekly winning streak, Twesha Dikshit and Fergal Smith, Reuters, September 26, 2025

Global markets weekly update - U.S. inflation holds pace in August, T. Rowe Price, September 26, 2025

SUBSCRIBE

If you’d like to automatically receive the Weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

What are the Magnificent 7 stocks? 7 of the market’s hottest stocks

Tiny US soft drinks firm changes name to cash in on bitcoin mania

Germany is investing billions in AI - but who is making a profit?