Lexicon Financial Group Weekly Update — November 5, 2025

“The relation between stock exchange and economy is like a man walking his dog. The man walks slowly, the dog runs back and forth.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

ISSUE 203

Looking Around

Disconnected… that is what stock markets and economies look like in 2025. There’s always been a difference between what happens on “Main Street” versus what happens on “Wall Street,” but today, the stock market and the economy might as well be on different planets.

For example, in the spring of 2020, the U.S. economy ground to a halt due to COVID-19 and its gross domestic product (GDP) fell 31.4 per cent annualized and unemployment soared to 14.7 per cent. Despite this bad economic news, during the first half of 2020, the S&P 500 rebounded by more than 20 per cent.

How is this disconnect possible?

The answer, pundits might argue, is that markets are forward-looking and anticipate recoveries long before they appear in the headlines. Investors at the time turned their focus away from the government responses – central bank interest rate cuts, extraordinary liquidity measures, and massive fiscal stimulus programs. Markets then began to anticipate a recovery before it appeared in the economic data. This recovery played out by late 2021, when unemployment had fallen below four per cent and economic growth had returned. This gap between the market’s expectations and the economic present is a recurring theme. In 2009, during the peak of the Great Recession, the S&P 500 began a dominant bull run by March. This happened in the face of rising unemployment and key economic indicators showing continuing deterioration. Markets anticipated that extraordinary policy measures would mark the beginning of recovery well ahead of the data.

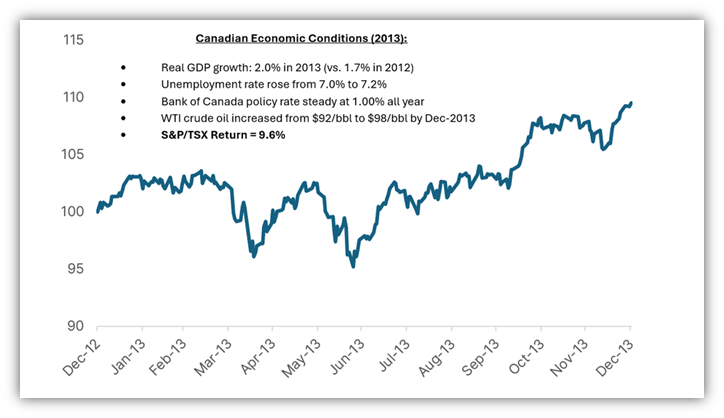

This feeling of disconnect also exists outside of the U.S. In 2013, the S&P/TSX Composite Index (TSX) rose, despite sluggish Canadian GDP growth and persistent unemployment. This rise was driven not by a strong domestic economy, but by factors such as rising global commodity prices and optimistic international outlooks. And it highlights an important point that is worth remembering: the TSX is shaped by sectors such as energy, resources, and financials that are deeply tied to global capital flows, sometimes diverging sharply from headlines about local economic growth.

The lesson here is that waiting for economic data to fully improve before investing can potentially lead to missed opportunities. Staying attentive to the broader context, policy moves, and sentiment shifts is one way of keeping on top of things.

The “economy” encompasses all productive activity in any given nation, which is reflected in numbers such as GDP, employment data, inflation, and consumer spending. Economists track these figures to measure the current health and momentum of growth in an economy. Stock markets are the venues where stocks, bonds, and currencies are traded, and they represent investors’ collective expectations for the future. Market swings can be rational, sometimes excessive, and occasionally reflect forces far removed from the current economic fundamentals.

Stock markets sometimes climb higher when economic data is at its worst. Consider a company that downsizes, putting a thousand employees onto the unemployment line. A community may suffer as a result, but it could be good for the bottom line of a corporate and boost their profitability.

By recognizing this dynamic, investors have the opportunity to maintain perspective through headline-driven volatility and stay focused on longer-term trends and their own long-term investment objectives. (1)

All of this said, there are three things that drive markets, regardless of how the economy is doing:

Monetary Policy – This is one of the biggest and most powerful financial drivers of the markets. When central banks reduce interest rates or inject liquidity (for example, by launching a massive bond-buying, or quantitative easing program), that tends to boost asset prices, even when the economy is weak. Low interest rates persuade investors to go hunting for returns – and that typically pushes up stock prices.

Corporate Earnings – Economic growth might be struggling but if big publicly traded companies are reporting good earnings, their stocks can still rally. The economy can be slow and sluggish while corporate profits (and therefore stock prices) are gaining momentum.

Investor Psychology – This is a significant driver of markets (which is why we have addressed behavioural finance in previous weekly updates). When investors feel optimistic, they may push stocks way higher than fundamentals justify. The other side of this is when fear takes over, markets can fall significantly, even if economic data looks strong. Simply stated, markets move on stories just as much as on data.

This needs to be remembered, as we may be in one of those disconnect periods right now. Stock markets have taken a hit this week – thanks to renewed fears over stubborn inflation, escalating tariff threats, and rising geopolitical tensions – even though the underlying economic data have held up relatively well. It’s also possible the recent AI-fueled optimism is being rebalanced against more traditional risks. The key here is to remained focused on the longer-term and not simply believe that dislocation between market perfomance and economic data will always track one another. (2)

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

Can the federal budget reset Canada's economy?

Most Americans Say USMCA Is Good for the US Economy

Economy Ranked: Europe’s Top Economies in 2026 by Projected GDP

Japan Economic Data Show Signs of Strength

China’s Economy at the Crossroads: Historic Slowdown Highlights Challenges of New Five-Year Plan

Looking Back

Last week, markets brushed off the Halloween scares and closed near record highs. By the way, we hope that you got your fill of candy.

The TSX, Canada's main stock index, added to its monthly gain last Friday, as technology shares rose and investors looked ahead to a seasonally strong year-end period for the market. The TSX was up 0.3 per cent for the week and up 0.8 per cent for the month, marking the sixth straight monthly advance and the longest such streak since 2021. Investors shrugged off disappointing domestic data – Canada’s GDP contracted 0.3 per cent in August against a consensus estimate of flat growth but an advance estimate suggested the economy might escape a recession in the third quarter. The technology sector rose 1.1 per cent, tracking gains for U.S. tech shares, while energy was up 0.5 per cent as the price of oil settled higher at $60.98 a barrel. (3)

U.S. stock markets ended last week mixed, with large-cap indexes posting gains and smaller-cap indexes declining. The technology-heavy Nasdaq Composite, which was boosted by continued outperformance from the mega-cap technology companies benefiting from artificial intelligence spending, led the way. Market breadth was notably narrow, as the S&P 500 Index advanced despite seven of its 11 sectors losing ground. According to FactSet, 64 per cent of S&P 500 companies had reported results as of Friday morning, with 83 per cent posting earnings that beat consensus estimates. Reactions to the week’s Magnificent Seven earnings, however, were mixed, with shares of Microsoft, Apple, and Meta Platforms declining after reporting, while Amazon and Alphabet traded higher. Shares of NVIDIA rose and pushed its market capitalization over USD 5 trillion midweek, making it the first company to ever cross that threshold.

Last week, the U.S. and China agreed to a one-year trade truce, which will see a reduction of U.S. tariffs on Chinese imports, a suspension of China’s export controls on rare earth materials, and a resumption of China’s purchases of U.S. soybeans and other agricultural products. The concessions in the agreement were relatively modest and may have left room for further trade war escalation in the long term. However, this agreement provided some temporary relief and helped boost investor sentiment during the week. This was helped by Federal Reserve (Fed) announcing, on Wednesday last week, that it would lower its target range for the federal funds rate by 25 basis points (0.25 percentage points) to 3.75-4.00 per cent as expected. However, Fed Chair Jerome Powell also suggested that, given the lack of economic data due to the ongoing federal government shutdown, policymakers could take a more cautious approach in December.

In local currency terms, the pan-European STOXX Europe 600 Index ended 0.67 per cent lower, after rallying to a fresh high, as expectations for more interest rate cuts from the European Central Bank (ECB) dwindled. Other major European stock indexes ended the week mixed. There was some good news, as a preliminary estimate showed that annual headline inflation in the eurozone slowed to 2.1 per cent in October from 2.2 per cent in September, which was in line with economists’ forecasts. Higher services costs were offset by lower energy prices. The core rate, which excludes volatile food and fuel prices, held steady at 2.4 per cent. Meanwhile, euro area gross domestic product expanded 0.2 per cent in the third quarter versus 0.1 per cent in the prior three-month period.

Japan’s stock markets climbed to fresh record highs last week, as the Bank of Japan’s (BoJ) decision to leave interest rates unchanged and hopes of a large-scale economic stimulus package buoyed sentiment. Strong results from Amazon and higher-than-expected sales forecasts from Apple also sparked a rally in technology stocks. Retail sales unexpectedly rose 0.5 per cent on an annual basis, rebounding from a 0.9 per cent decline in the prior month. The unemployment rate held at 2.6 per cent in September, staying at the highest level since July 2024.

Mainland Chinese stock markets ended the week on a mixed note, as worries about a growth slowdown outweighed optimism about easing U.S.-China trade tensions. Concerns about China’s longer-term growth ratcheted up after a recent high-level meeting of the country’s leaders failed to come up with any potent policy support. While analysts said China’s emphasis on consumption was positive, it fell short of targeting a specific level of household consumption in the country’s gross domestic product (GDP). According to World Bank data, China’s household consumption level as a percentage of GDP is currently about 40 per cent versus the global average of 56 per cent. (4)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

Deciphering the Disconnect Between Markets and the Economy, Stu Morrow, Mawer Investment Management Ltd., September 24, 2025

Investing In The Disconnect: Why The Stock Market And The Economy Don’t Always Align, Theodora Lee Joseph, CFA, Finimize

TSX extends monthly winning streak as technology shares climb, Fergal Smith, Reuters, October 31, 2025

Global markets weekly update - Fed cuts rates, ECB and BoJ hold steady, T. Rowe Price, October 31, 2025

SUBSCRIBE

If you’d like to automatically receive the Weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

The Growing Disconnect Between the Stock Market and the Economy

The Economy Looks Shaky. So, Why Is The Stock Market Surging?

Why Is Canada’s Stock Market Near All Time Highs When the Economy Is in Free Fall?