Lexicon Financial Group Weekly Update — June 4, 2025

“Only when the tide goes out do you discover who’s been swimming naked.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

Looking Around

Home maybe where the heart is but, these days, it’s not as affordable as it once was.

The average price of a home in 1975 was around $42,000. Adjusted for inflation, today that would be approximately $240,000. Today, the national average cost of a home in Canada is around $700,000. That’s quite a difference.

Interestingly, the rise in Canadian home prices has grown at about six per cent annualised, when inflation has been tracking at around two to three per cent, annually. When we look at the inflation-adjusted annual growth rate, home prices have risen by about two per cent each year. Put another way, the real driver in home prices is something other than inflation. And, generally, in economics when the price of a good or service increases, it is related to one thing: consumer demand.

Demand for homes has always been strong, but is enhanced in periods of low interest rates. For over a decade in the 1990s, low-interest-rate policies made borrowing attractive. Monthly mortgage payments become more affordable, and house prices begin to rise, thanks to the increase in affordability, which leads to an increase in demand.

But despite the leather tie tucked away in the back of the closet, we’re not living in the 1990s. It’s 2025. How affordable are homes in Canada today? Well, let’s look at the chart below.

In 1975, the inflation-adjusted average home price was the equivalent of buying at $240,000 in today’s dollars. However, mortgage rates were trending at around 10 per cent and monthly mortgage payments were the equivalent of spending approximately $1,900 per month in today’s dollars.

And, mortgage rates remained high all throughout the 1980s. Some clients will remember rates as high as 20 per cent; this certainly stifled the demand for housing. Who could afford an inflation-adjusted mortgage payment of $3,000 or even $3,500?

Today’s prices for houses seem absurdly out of reach, but history shows that we’ve been here before. And it was not that long ago. The three high points in the chart for mortgage payments have to do with generational waves from boomer to millenial. (1)

Government at all levels in Canada are looking at possible solutions aimed at increasing the supply of homes to make them more affordable. More supply of any good or service reduces the price, as customers have options. This is good for prospective home buyers but not necessarily for homeowners.

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

Canada's economy grows faster than expected in first quarter

Eurozone inflation falls below ECB 2 per cent target in May: Rate cut in sight

Despite trade policy uncertainty, US economy has been resilient

In Japan, a U.S. security ally, anger over ‘unacceptable’ steel treatment

U.S.-China Trade War Morphs From Tariffs Into Fight Over Supply Chain

You see, many Canadians who bought homes (even when they weren’t deemed affordable) have done well. Their homes have become a bigger share of family or individual wealth. And, some Canadians have leveraged the increased value in their home, using a home equity line of credit (HELOC) to access funds at low interest rates.

We only need to look back to 2008 in the United States to see what could happen. Then, home owners borrowed excessively against property. When the value of the property fell, lenders panicked and foreclosed on property, created an oversupply. Which led to declines in property values in a vicious circle that took a Wall Street bailout to stop.

According to Statistics Canada, in September last year, outstanding HELOC balances totalled $170.8 billion – up three per cent from 2023 and the highest level in nearly two years. (2)

We’re not there yet, but consider it as a reminder of two things. First, we’ve seen situations like this before. Second, debt tied to an asset that could experience a decline in value might not be as secure today as it once was. If you have a large home equity line of credit, it may be worth planning on how to pay that down. Let’s chat.

Looking Back

Last week, stock markets were focused on two drivers - mega-cap technology earnings and tariff headlines. As you may know, the key driver of stock-market performance is corporate earnings growth, and United States (U.S.) companies (especially in the technology sector) as well as Canadian companies have delivered solid results in the first quarter of 2025.

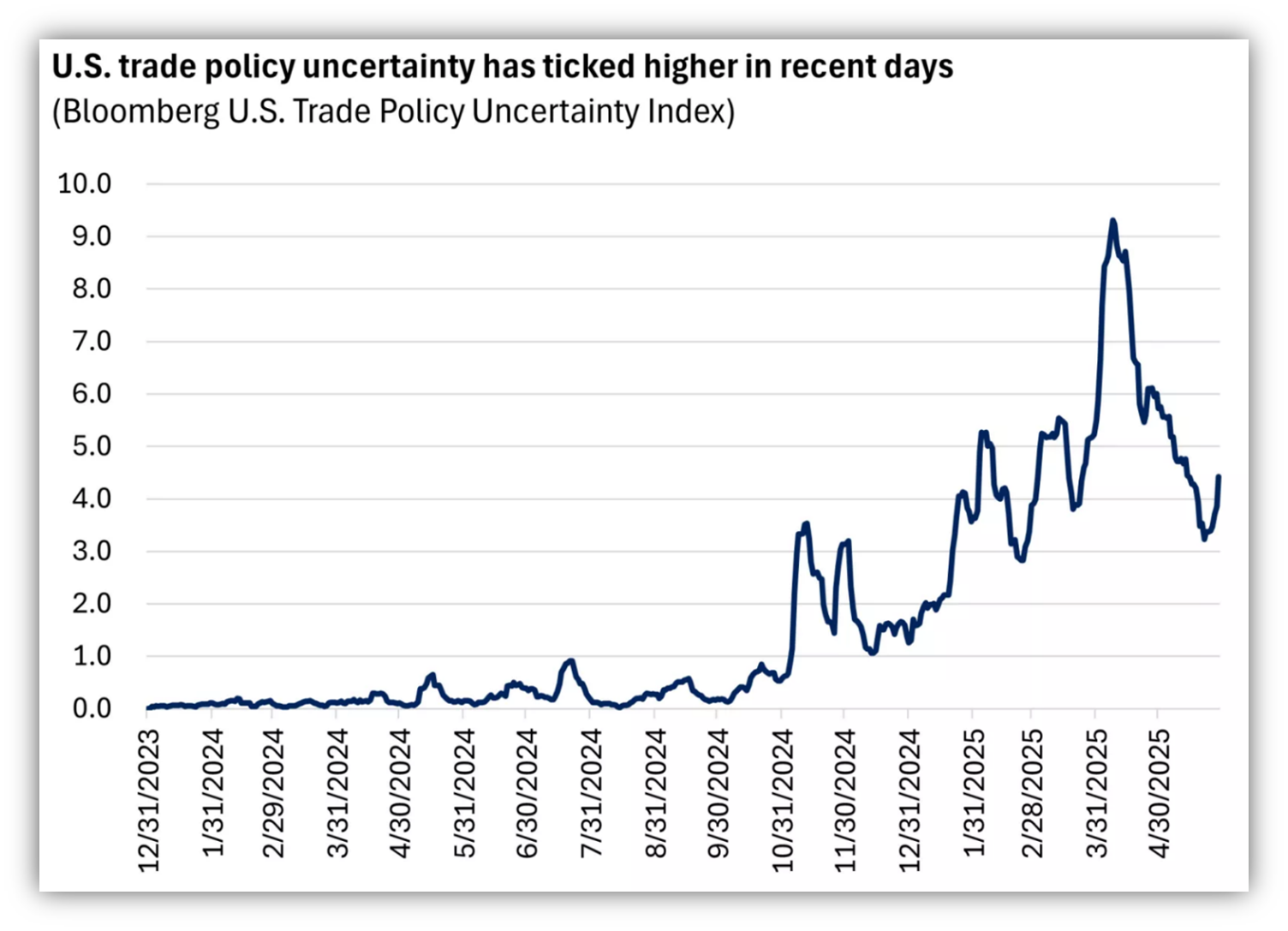

Trade tariffs are still very much the subject of the day and continue to add to market uncertainty that leads to increased market volatility.

Source: FactSet, May 2025. S&P 500 and GICS sectors of the S&P 500

Source: Bloomberg, May 2025.

Investors will have to wait to get more clarity about tariffs, ahead of the July 9 end of the 90-day pause on Canadian and other trading partner tariff rates, as well as the August 12 end of the 90-day pause with China. So far, U.S. and Canadian companies have been able to navigate tariff uncertainty and contain prices, partially due to the inventories they built ahead of tariff-led price increases. The month of May was positive for the S&P 500 index and the S&P/TSX composite index (TSX). And, historically, a strong May has boded well for the forward 12-month market performance but only time will tell. (3)

The TSX was down 0.1 per cent last Friday but was up 1.1 per cent for the week. For the month of May, the TSX was up 5.4 per cent. Canadian gross domestic product increased at an annualized rate of 2.2 per cent in the first quarter, which was above estimates for a gain of 1.7 per cent. The energy sector fell 1.8 per cent on Friday, as the price of oil settled lower at $60.79 a barrel and after oil sands company MEG Energy said it evacuated all nonessential workers from its Christina Lake production facility in northern Alberta due to wildfires burning in the area. The materials sector, which includes metal mining shares, also lost ground as the price of gold fell. However, heavily weighted financials added were up 1.3 per cent for the week in which Canada's biggest banks reported quarterly earnings. (4)

U.S. stocks rebounded during the holiday-shortened week, although major indexes faced some selling pressure late last week. The Nasdaq Composite led the way, gaining 2.01 per cent. According to S&P Global’s Flash Purchasing Managers’ Index (PMI) survey data, U.S. business activity growth rebounded in May, as activity in the services sector improved from a 17-month low in April to a PMI reading of 50.8 to 52.3 in May. The Manufacturing PMI also improved, increasing from 50.2 in April to a three-month high of 52.3 in May. Both readings were better than consensus estimates and signalled expansion. However, this report also noted that prices rose at the fastest rate since August 2022. This is overwhelmingly due to tariffs. Furthermore, the Bureau of Economic Analysis (BEA) reported that its core personal consumption expenditures (PCE) index - the Federal Reserve’s preferred measure of inflation - rose 2.5 per cent year over year in April but was down from 2.7 per cent in March and the lowest annual reading since 2021.

The pan-European STOXX Europe 600 Index ended up 0.65 per cent higher last week after U.S. President Trump announced that he would give the European Union (EU) more time to negotiate a trade deal before 50 per cent tariffs take effect. Other major European markets followed suit. Slowing inflation in some major European economies also reinforced expectations that the European Central Bank (ECB) would cut interest rates.

Stock markets in Japan rebounded last week amid increasing hopes of a trade agreement between the U.S. and Japan. Prime Minister Shigeru Ishiba and President Donald Trump reportedly held a constructive telephone call last Thursday ahead of the fourth round of talks in Washington. This, together with Trump’s backing for Nippon Steel’s bid for U.S. Steel, fueled speculation that both sides are making progress towards an accord by the time of the G7 meeting in mid-June, where both leaders plan to meet.

In China, major stock markets declined again last week,as a light economic calendar and a pause in the U.S.-sparked trade war dampened buying sentiment. After the pause in the tariff war, the Chinese government has stepped up efforts to help shield its economy ahead of the expiration of the 90-day negotiation window in August. China plans to allocate RMB 500 billion, or roughly USD 70 billion, of capital to invest in new infrastructure projects. Chinese officials are still hashing out the next Five-Year Plan (the economic blueprint for the country) and reports suggest that China intends to stick with its manufacturing-driven economic strategy, which the U.S. and Europe have criticized for fueling trade imbalances. (5)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

The Evolution Of Canadian Home Prices: Affordability, Interest Rates, And The Generational Homeownership Cycle, Chris White, Canadian Money Saver, February 27, 2025

Mortgage Digest: HELOC usage rises to near two-year high as borrowing picks up, Steve Huebl, Canadian Mortgage Trends, December 17, 2024

Weekly market wrap, Mona Mahajan, Edward Jones, May 30, 2025

TSX posts biggest monthly gain since November as political risk potentially peaks, Fergal Smith, Reuters/Yahoo finance, May 30, 2025

Global markets weekly update - U.S. federal appeals court temporarily reinstates tariffs amid legal challenges, T. Rowe Price, May 30, 2025

SUBSCRIBE

If you’d like to automatically receive the Weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

Video: Will it be easier or harder for Canadians to buy a home in 2025?

Here's how important homeownership is to building wealth in Canada

Canada's housing affordability crisis may persist for years despite rate cuts