Lexicon Financial Group Weekly Update — January 28, 2026

“The US dollar is our currency but your problem.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

ISSUE 213

Looking Around

The United States (U.S.) economy is still growing as output expanded strongly, driven by consumer and government spending. But it might be showing signs of strain. Inflation, which had been drifting lower, is moving higher again as businesses pass tariff costs on to consumers. Consumer confidence appears to be falling, the labour market is cooling, and the U.S. dollar has depreciated sharply since March of 2025. (1)

On Tuesday this week, the value of the U.S. dollar fell again after the President expressed little concern about recent drops.

In the wake of these comments, the value of the dollar as measured by the benchmark ICE U.S. Dollar Index declined, putting it on track for its worst one-day drop since April 2025. The ICE U.S. Dollar Index is a leading benchmark for the international value of the U.S. dollar and the world's most widely recognized traded currency index. It measures the strength of the U.S. dollar compared with a basket of foreign currencies, such as the Euro, British pound, Japanese yen, Canadian dollar, and Swiss franc. It rises when the U.S. dollar's value increases and declines when its value drops. The dollar’s value directly impacts importers, who are purchasing goods from abroad using a weaker dollar. This creates an additional incentive for people to purchase goods and services locally where a dollar is a dollar.

As Canadians, we’ve often fixated on exchange rates. A weaker dollar makes a country’s exports cheaper, which can provide a short-term boost to the economy. Balancing this has been a cornerstone of economic and fiscal policy. If the dollar is too strong, exporters lose access to foreign markets. If the dollar is too weak, imports become expensive.

That said, since Trump rolled out his global tariff agenda, the trajectory of the U.S. dollar has been downward. Although stocks recovered after the market chaos sparked by the tariffs, the U.S. dollar has not. (2)

The recent abrupt moves in the Japanese yen, after Japan’s Prime Minister Sanae Takaichi called a snap election, also helped fuel the U.S. dollar drop. (3) This just underscores how important geopolitical events—especially in the short term—can be in currency markets.

The greenback has been under pressure for awhile now. Long-standing concerns include rising U.S. debt burdens, the independence of the Federal Reserve, and uncertainty around “here today, gone tomorrow” tariff policies. As we move further into 2026, there are three fundamental questions that may impact how we position client investment portfolios.

The weakness of the U.S. dollar reflects cyclical and policy-driven forces such as slowing U.S. economic growth, narrowing interest rate differentials, persistent fiscal deficits, and elevated inflation. However, it continues to serve as the world’s dominant reserve and settlement currency.

According to Morningstar, among the thirty-four major developed- and emerging-markets currencies it tracks, only nine are currently more overvalued than the U.S. dollar, which suggests that while cheaper, the U.S. dollar is far from “cheap.”

So, we do not expect a structural collapse of the currency, despite what “influencers” on social media might be saying.

Beginning last year, we took small steps towards enhancing the diversification of client portfolios by moving assets out of the U.S. market towards global and Canadian markets. Not only does this improve geographic diversification, it also acts as a hedge against further U.S. dollar weakness.

The weakness of the U.S. dollar in 2025 likely signals a turning point in its long cycle of strength but not the end of its global dominance. This shift presents an opportunity that global diversification may play a more significant role in portfolio returns, going forward, than it has in the recent past. (4)

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

Why Trump’s Tariffs Didn’t Break Canada

U.S. stocks recover half of the prior day’s plunge after Trump calls off Greenland-related tariffs

Op-ed: Post-Greenland, the EU needs to make shared economic deterrence a priority

Japan PM's tax giveaway roils markets and worries voters

China’s economy is growing, but it’s stuck in a deflationary trap

Looking Back

Canada’s main stock market, the S&P/TSX composite index (TSX), ended last week on a new high and up 0.3 per cent for the week. The TSX benefited from gains in the basic materials sector alongside an increase in the price of precious metals as both gold and silver had a very strong week. Year to date the TSX is up 4.5 per cent. (5)

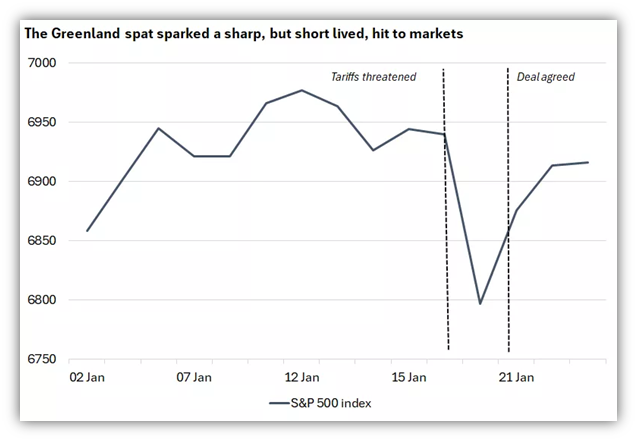

U.S. markets were closed last Monday in observance of Martin Luther King Jr. Day. What followed was a volatile, holiday-shortened week for U.S. markets, which all finished the week lower. As geopolitics again became a focus, stocks traded sharply lower on Tuesday, with the S&P 500 Index posting its largest daily decline since October, amid renewed fears of a global trade war after President Donald Trump announced that he would impose new tariffs on European nations that opposed the U.S. purchasing or otherwise taking control of Greenland. However, these markets reversed course on Wednesday after Trump softened his stance and stated that he would no longer be imposing the tariffs scheduled to go into effect at the beginning of February. U.S. stocks rallied on the news, ultimately finishing the week above their worst levels.

U.S. stock markets ended last week mixed.

Source: Bloomberg and Edward Jones

On the economic data front, an updated estimate from the Bureau of Economic Analysis (BEA) showed that the U.S. economy grew at a faster-than-expected pace in the third quarter of 2025 — real gross domestic product (GDP) increased at an annual rate of 4.4 per cent (slightly higher than a previous estimate of 4.3 per cent and up from the second quarter’s 3.8 per cent pace. This upward revision was largely due to higher exports and investment. The BEA also released its November core personal consumption expenditures (PCE) price index — the preferred inflation gauge of the Federal Reserve (Fed) — which rose 0.2 per cent from the prior month. On a year-over-year basis, the index rose 2.8 per cent, which remains well ahead of the Fed’s long-term inflation target of two per cent.

The week’s employment data also suggested that layoffs remain relatively subdued despite some signs of softening in the U.S. labour market. New applications for unemployment benefits for the week ending January 17 came in at 200,000, a slight increase from the previous week’s revised 199,000 and below estimates for around 207,000. Continuing unemployment claims came in at 1.849 million in the week ended January 10 — a decrease from the prior week’s downwardly revised 1.875 million. Meanwhile, U.S. Treasuries posted modest losses last week, with short-term yields edging higher and longer-term yields declining slightly. Corporate bonds, however, posted gains, outperforming U.S. Treasuries amid improving macroeconomic sentiment and resilient investor demand.

The pan-European STOXX Europe 600 Index ended 0.98 per cent lower amid renewed trade and geopolitical uncertainty. Other major European stock indexes also fell. According to surveys of purchasing managers by S&P Global, business activity in the eurozone expanded modestly in January, thanks to an increase in new orders. However, it appears that the European Union’s (EU’s) trade deal with Mercosur, the South American trading bloc, faces a potentially long delay. The European Parliament voted by a slender majority in favour of a resolution to seek an opinion from the Court of Justice of the European Union on whether the texts of the agreement comply with EU treaties.

Japan’s stock markets fell last week, as domestic political uncertainty weighed on markets and talk of unfunded tax cuts led Japanese government bond (JGB) yields to spike as investors grew increasingly concerned about the country’s ongoing fragile finances. Prime Minister Sanae Takaichi’s announcement last Monday of an early parliamentary election on February 8 was widely anticipated, as she seeks to consolidate power and secure public support for her aggressive spending plans. Takaichi surprised investors by pledging that if she secures a fresh mandate for her new coalition, the government will reduce the consumption tax on food (currently at eight per cent) to zero per cent for two years. This left investors questioning how this lost tax revenue would be offset and led to growing concerns about the health of Japan’s finances. These concerns led to the yield on the 10-year JGB rising to 2.26 per cent from 2.18 per cent at the end of the previous week, which was the highest level since 1997.

Mainland Chinese stock markets ended last week mixed after several indicators underscored uneven growth across the economy. Year on year China’s economy grew 4.5 per cent in the fourth quarter of 2025 and expanded to 5 per cent for 2025. However, this marked the slowest growth pace since China reopened after pandemic lockdowns in late 2022. Other indicators showed that domestic demand remains weak. Retail sales, a key barometer of consumer demand, edged up 0.9 per cent in December which lagged estimates and marked the weakest pace since the pandemic reopening.

Although China’s industrial sector powered its economy for 2025 amid solid demand for the country’s exports, many analysts believe that sustaining the current pace of growth will be difficult as protectionism surges globally. The first quarter of 2026 may be particularly challenging due to comparisons with the year-ago period, when China recorded strong growth as consumer subsidies bolstered spending and exports surged amid front-loading by trade partners. (6)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

The US economy under Donald Trump, The Economist, January 29, 2026

Dollar has its worst day since April after Trump says he's not concerned with recent slide, Steve Kopack, NBC News, January 27, 2026

Takaichi's pledge to scrap food tax for 2 years unsettles markets and voters, Julien Girault and Hiroshi Hiyama, Japan Today, January 28, 2026

What a Weaker US Dollar Means for Investors in 2026 and Beyond, Hong Cheng, Morningstar, December 30, 2025

S&P/TSX composite hits new high amid calmer market, The Canadian Press, CTV News, January 23, 2026

Global markets weekly update - U.S. third-quarter economic growth revised higher, T. Rowe Price, January 23, 2026

SUBSCRIBE

If you’d like to automatically receive the Weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

Understanding Currency Depreciation: Causes and Effects

Japan PM Takaichi may call early election, coalition partner says

Why Japan’s economic plans are sending jitters through global markets