Lexicon Financial Group Weekly Update — February 18, 2026

“Risk-taking is an inevitable ingredient in investing, and in life, but never take a risk you do not have to take.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

ISSUE 216

Looking Around

More than a few of the activities at this year’s winter Olympics are risky, if not downright dangerous. Despite this, athletes continue to launch off platforms, speed down mountain slopes, and do backflips on the ice for the possibility of earning a medal.

For them, the risks are calculated. They’ve trained for this, after all. But they take risks because, to them, becoming an Olympic champion makes it a worthwhile pursuit.

We all have different appetites for risk. Especially when it comes to investing.

Portfolio managers and behavioural finance professionals evaluate an investor’s “appetite for risk.” This is just a fancy way of trying to determine how people feel about potential outcomes: both positive and negative. If people are willing to accept negative returns in pursuit of positive ones, they are willing to take on more risk. Judging the degree of investor risk appetite at any given point in time is important, as investor behaviour can be impacted dramatically by the markets. Someone who feels comfortable taking on risk, when markets are doing well, may change their mind when market liquidity declines or when asset prices fluctuate violently. Often, these events are associated with the loss of risk appetite by investors. (1)

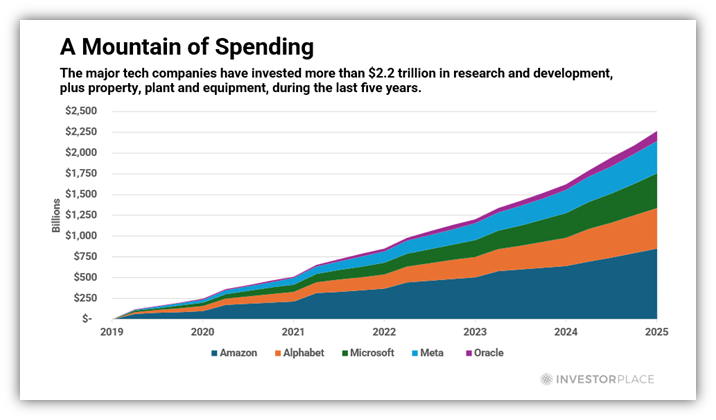

At the moment, it appears that investors are reducing their appetite for risk when it comes to technology stocks. The Magnificent Seven stocks (which some are now calling the Fab Four) remain under pressure, as the debate over return on investment in artificial intelligence (AI) intensifies. In another high technology sector, semiconductor stocks and some software companies are struggling. While some pundits continue to caution that AI is a potential wrecking ball across an increasing number of industries, investors at the moment seem to be growing concerned about the high level of capital spending and the potential return. Which is exactly the type of reversal we’re talking about. A few years ago, technology was a “can’t miss” asset class, attracting assets hand-over-fist and driving performance across the entire stock market. (2)

How quickly things change!

So far this year, alternative currency bitcoin has tumbled in value by more than 20 per cent. According to a recent CryptoQuant report, U.S. exchange-traded funds (ETFs) which had been buying up Bitcoin last year, are selling it this year. Deutsche Bank analysts, in a note to clients, stated that these ETFs have seen billions of dollars flow out each month since the October 2025 downturn, which signals that traditional investors are losing interest, and overall pessimism about crypto is growing. (3)

We’ve never invested directly in cryptocurrency for client portfolios. But we wrote about it back in 2021.

Many were counting Canada’s men’s Olympic hockey team down and out, but they came back to win over Czechia in overtime. Nobody is calling the tech rally over and the crypto crowd is certainly not calling for the end of Bitcoin. Until then, we’ll continue to review the risk/reward situation and make investment decisions that are in line with your investment objectives.

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

2026 Canada Stock Market Outlook: Rally to Continue, but Gains May Be Tamer

S&P 500 closes little changed after soft inflation report, index notches losing week: Live updates

EU leaders vow to accelerate single market, in struggle to compete with US, China

Japan Stocks See World-Beating Start to 2026 on Takaichi Boost

China consumer inflation rises less than expected in January as producer price deflation persists

Looking Back

Last week was packed with a flurry of economic data coupled with bouts of stock market volatility and rising investor concerns.

Canada’s S&P/TSX composite index (TSX) climbed higher last Friday and ended up 1.9 per cent for the week. The TSX again benefited from gains in the basic materials sector while another factor could be investors seeing opportunities after some swings in the precious metals market. Outside of basic materials, auto parts manufacturer Magna International Inc. shares soared 18.94 per cent after it laid out guidance for rising profits in 2026. (4)

Major stock markets in the United States (U.S.) finished lower last week, as concerns regarding the disruptive potential of AI weighed on stocks across a broad range of industries. The technology-heavy Nasdaq Composite fared worst, shedding 2.10 per cent and is -2.99 per cent year to date. The Russell 1000 Value Index outperformed its growth counterpart for the seventh consecutive week.

Source: Bloomberg, Edward Jones

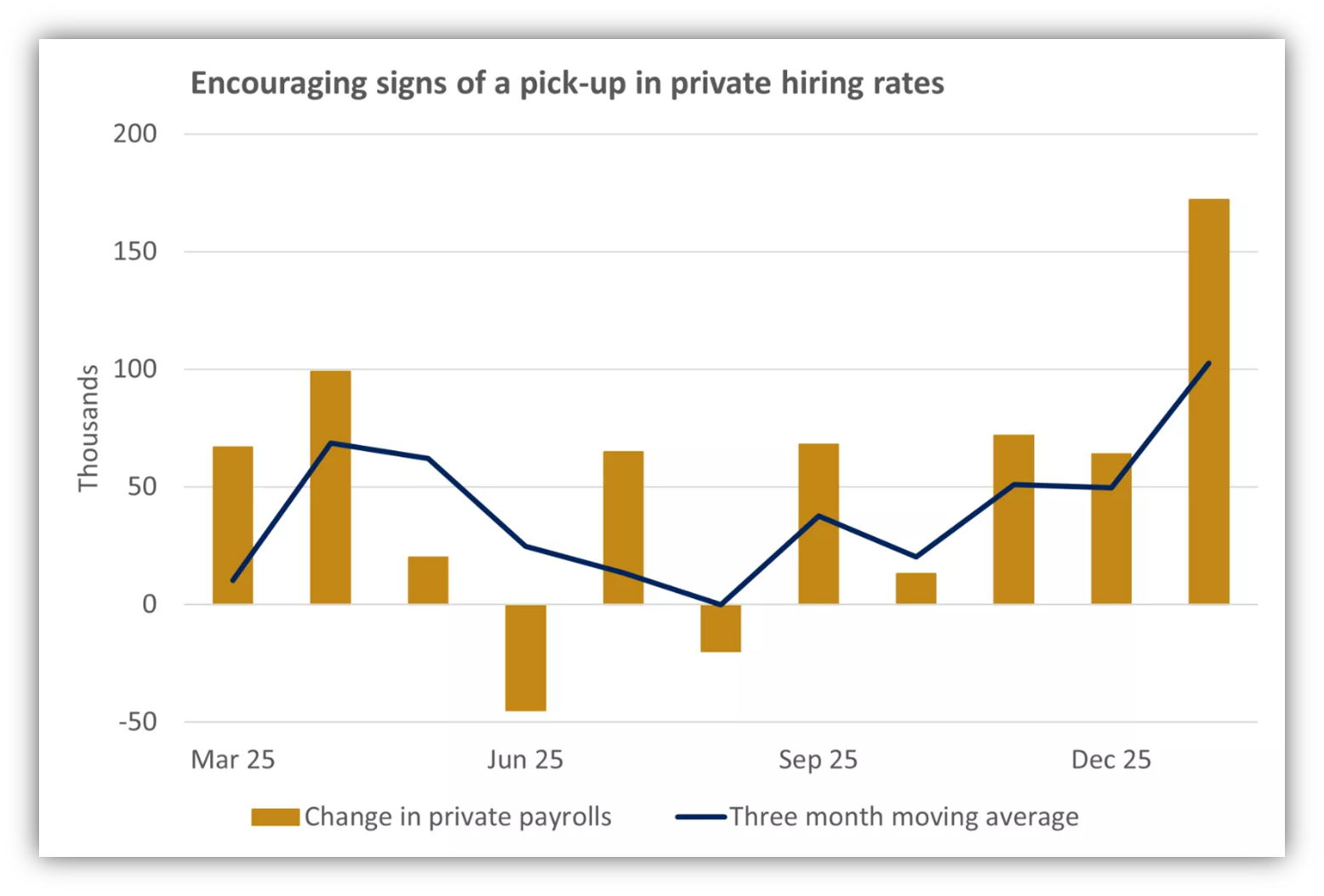

Hiring in the U.S. was stronger than expected in January, according to data from the Bureau of Labor Statistics (BLS). The BLS reported that U.S. employers added 130,000 jobs In January, which is well ahead of consensus forecasts and the highest monthly gain in over a year.

The unemployment rate also declined 1 per cent to 4.3 per cent in December. This upside surprise appeared to dampen investors’ expectations for an interest rate cut in the near term, as the probability of the Federal Reserve (Fed) keeping rates unchanged through June rose from around 25 per cent to over 40 per cent, according to the CME FedWatch tool.

The BLS also released consumer price index (CPI) data for January, which indicated that prices rose 0.2 per cent month over month and 2.4 per cent year over year, down from December’s readings of 0.3 per cent and 2.7 per cent, respectively. Both readings were below consensus estimates, thanks in part to a notable decline in energy prices. Core prices—which exclude volatile food and energy costs—increased 0.3 per cent for the month, up from 0.2 per cent in December and in line with estimates.

The pan-European STOXX Europe 600 Index hit a new high last week but ended broadly unchanged, eking out a 0.09 per cent gain in local currency terms. European markets were volatile and ended the week mixed, as investors digested significantly better-than-expected U.S. jobs data, while concerns about AI disruption also spread to Europe.

Surprisingly, the number of employed people in the euro area rose by 0.2 per cent in the final quarter of 2025, a larger-than-expected increase. Job growth was particularly strong in Spain, up 0.8 per cent from the third quarter. In contrast, German employment showed a small contraction, while in France, the unemployment rate rose to 7.9 per cent – its highest level since the third quarter of 2021.

Japan’s stock markets rose sharply over the week on the outcome of Japan’s February 8 lower house election, where Prime Minister Sanae Takaichi’s Liberal Democratic Party (LDP) secured a supermajority, winning more than two-thirds of seats. This LDP landslide victory was a testament to the public’s backing of Takaichi’s policy agenda, focused on aggressive fiscal spending, investment, and targeted tax cuts. It also opened the door to her government pursuing an amendment to Japan’s constitution, specifically the pacifism clause enshrined in it, for the first time in the post-World War II period. In practice, this sets Japan up for a large increase in its defense spending in the coming years.

Chinese stocks ended last week modestly higher ahead of the Lunar New Year holidays – it’s the year of the Horse, by the way. Deflation is still plaguing China as its consumer price inflation decelerated in January, while producer prices remained in deflation territory. These deflationary pressures are expected to persist, in the absence of more aggressive stimulus measures by the Chinese government.

Meanwhile, the People’s Bank of China (PBOC) reaffirmed that it will implement a “moderately loose” monetary policy in 2026. The central bank pledged to strengthen financial support for key areas to boost domestic demand, technological innovation, and small to medium-sized enterprises. PBOC Governor Pan Gongsheng indicated that there is more room for further reserve requirement ratio and interest rate cuts. The central bank also injected liquidity to help lenders meet expected cash demand before Lunar New Year. (5)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

Measuring Investors' Risk Appetite - European Central Bank, Financial Stability Review, June 2007

Investors Struggle as AI Wrecking Ball Reshapes the Market The Chronicle, James DePorre, TheStreet Pro, February 17, 2026

‘Crypto winter’: Why is Bitcoin crashing despite Trump’s support? Priyanka Shankar, Al Jazeera, February 6, 2026

S&P/TSX composite up more than 600 points, U.S. markets mixed to close volatile week, The Canadian Press via BNN Bloomberg, February 13, 2026

Global markets weekly update - U.S. January job gains hit highest level in over a year, T. Rowe Price, February 13, 2026

SUBSCRIBE

If you’d like to automatically receive the Weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

How to Understand Your Investing Risk Appetite

The magnificent seven drove markets. Now they’re pulling in different directions.

Video – Bitcoin & software sell-off: There's a 'huge correlation'